reverse sales tax calculator quebec

55 billion GST rebates to help who lost income due to COVID-19. GSTQST Calculator Before Tax Amount.

Quebec Sales Tax Calculator On The App Store

Calculating sales tax in Quebec is easy.

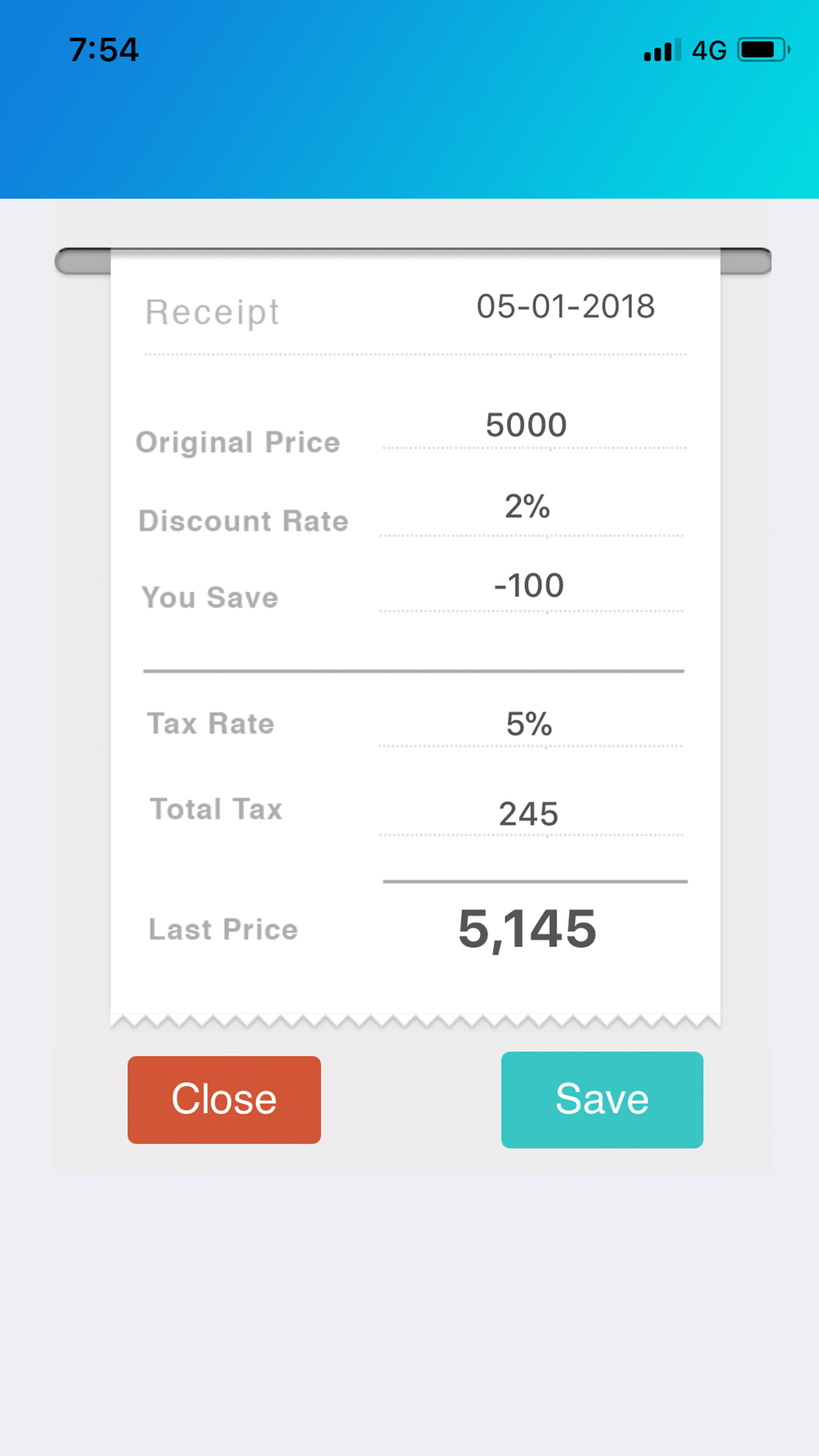

. Regarding the sale of the book only the gst must be taken into account in this type of calculation. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Quebec applies 9975 QST and 5 GST to most purchases meaning a 14975 total sales tax rate.

The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013. Reverse Sales tax calculator British-Columbia BC GSTPST 2017. OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price.

Why A Reverse Sales Tax Calculator is Useful. However you can give more or less depending on the quality of service received. Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount.

This app can also do invert calculation and supports both english and french languages. Montant sans taxes Taux TPS Montant de la TPS. Choose which one you are using in the drop.

Here is how the total is calculated before sales tax. The TIP is at least equal to the sum of the taxes TPS TVQ is 15. Look no further than this reverse tax calculator for Canadians.

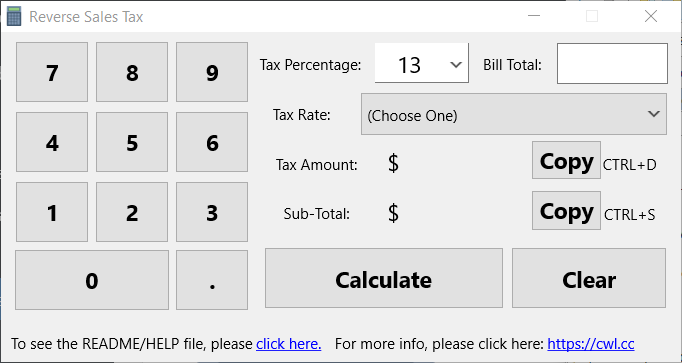

The rate you will charge depends on different factors see. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. You also have the possibility of doing the reverse.

When a price inclusive the tax is mentioned in such cases reverse tax is applied. You will need to input the following. The qst was consolidated.

Enter the final price or amount. Reverse sales tax calculator quebec Thursday March 3 2022 Edit. HST tax calculation or the Harmonized Sales Tax calculator of 2022 including GST Canadian government and provincial sales tax PST for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador.

British Columbia Manitoba Québec and Saskatchewan. Calculator to calculate sales taxes in Quebec. Calculate GST with this simple and quick Canadian GST calculator.

Instead of using the reverse sales tax calculator you can compute this manually. You can use this method to find the original price of an item after a. Amount without sales tax QST rate QST amount.

For example if the full payment is 5798 and you paid 107 sales tax you can enter these numbers into our calculator to determine your original pre-tax price. Enter your purchased amount and hold and behold the tax is automatically calculated for you. The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax.

Enter an amount into the calculator above to find out how what kind of sales tax youll see in Quebec Canada. To use the sales tax calculator follow these steps. Formula for reverse calculating HST in Ontario.

While this is convenient you optionally can also include the tip percentage. GST stands for General Sales Tax. - Tous droits réservés Ontario.

This free calculator is handy for determining sales taxes in canada. Canada Sales Tax Calculator By Tardent Apps Inc Canada Sales Tax Calculator On The App Store Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca Reverse Gst. Quebec Sales Tax Calculator.

A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Montant avec taxes Montant TPS et TVQ combiné 114975 Montant sans taxes. Relief measures for individuals and businesses by Revenu Québec.

Amount without sales tax x. Only four Canadian provinces have PST Provincial Sales Tax. The reverse calculator below takes into account all GST HST PST and QST for all the provinces in Canada.

Beware some bars restaurants charge a tip on the amount TTC while it should be calculated on the amount HT. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Who the supply is made to to learn about who may not pay the GSTHST.

Rather than calculating sales tax from the purchase amount it is easier to reverse the sales tax and separate the sales tax from the total. Montant sans taxes Taux TVQ Montant de la TVQ. Plus Tax Amount 000.

06 r6 100sum p5q5 p6 o6p5. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Reverse Sales Tax Calculator Quebec.

On March 23 2017 the Saskatchewan PST as raised from. Minus Tax Amount 000. It is Quebecs name for the Provincial Sales Tax that is applied in several other provinces.

Amount with sales tax 1 HST rate100 Amount without sales tax. Calculates the canada reverse sales taxes HST GST and PST. Reverse Sales Tax Formula.

Type of supply learn about what supplies are taxable or not. Calculate the total income taxes of a Quebec residents for 2021. Reverse GSTQST Calculator After Tax Amount.

To calculate the total amount and sales taxes from a. If youre selling an item and want to receive 000 after taxes youll need to sell for 000. Amount without sales tax GST rate GST amount.

Below are instructions on how to use it. What taxes does Quebec apply. This is the after-tax amount.

In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975. Reverse GSTQST Calculator After Tax Amount. Tax returns of individuals due date also deferred.

Now you divide the items post-tax price by the decimal value. Sales tax calculator GST QST 2016. 13 rows Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is.

QST stands for Quebec Sales Tax. Where the supply is made learn about the place of supply rules. Voici la façon dont est calculé le montant avant taxe.

Current HST GST and PST rates table of 2022. Enter either the sales tax amount in dollars such as 10 for 10 or the sales tax rate such as 85 for 850. It will work as a reverse GST calculator a reverse HST calculator a reverse GST PST calculator and even a reverse GST QST calculator.

For the second option enter the sales tax percentage and the gross price of the item which is a monetary value. The following table provides the GST and HST provincial rates since July 1 2010. To find the original price of an item you need this formula.

Sales tax amount or rate. In Québec it is called QST Québec Sales Tax and in Manitoba it is RST Retail. Useful for figuring out sales taxes if you sell products with tax included or if you want to extract tax amounts from grand totals.

Canada Sales Tax Calculator On The App Store

Canada Sales Tax Gst Hst Calculator Wowa Ca

Canada Sales Tax Calculator By Tardent Apps Inc

Gst Calculator Goods And Services Tax Calculation

Canada Sales Tax Calculator By Tardent Apps Inc

Canada Sales Tax Calculator On The App Store

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Reverse Hst Calculator Hstcalculator Ca

Pst Calculator Calculatorscanada Ca

![]()

Quebec Sales Tax Calculator On The App Store

Tax Sales Calc Free Download App For Iphone Steprimo Com

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Reverse Sales Tax Calculator Gst And Qst Calendrier Live

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price